In my experience, the vast majority of people can’t accurately predict where their money will go this month.

That makes planning for the month (let alone planning for the long term) extremely difficult.

It also leads to an increased baseline of stress. Add in economic headwinds or loss of income, and it’s scary not knowing where your money is going.

But fortunately, there’s an easy, free tool that can help you see where your money is going each month. It can help you make a plan for your money, so you feel less stressed and more confident about what to do next.

That free tool is Google Sheets.

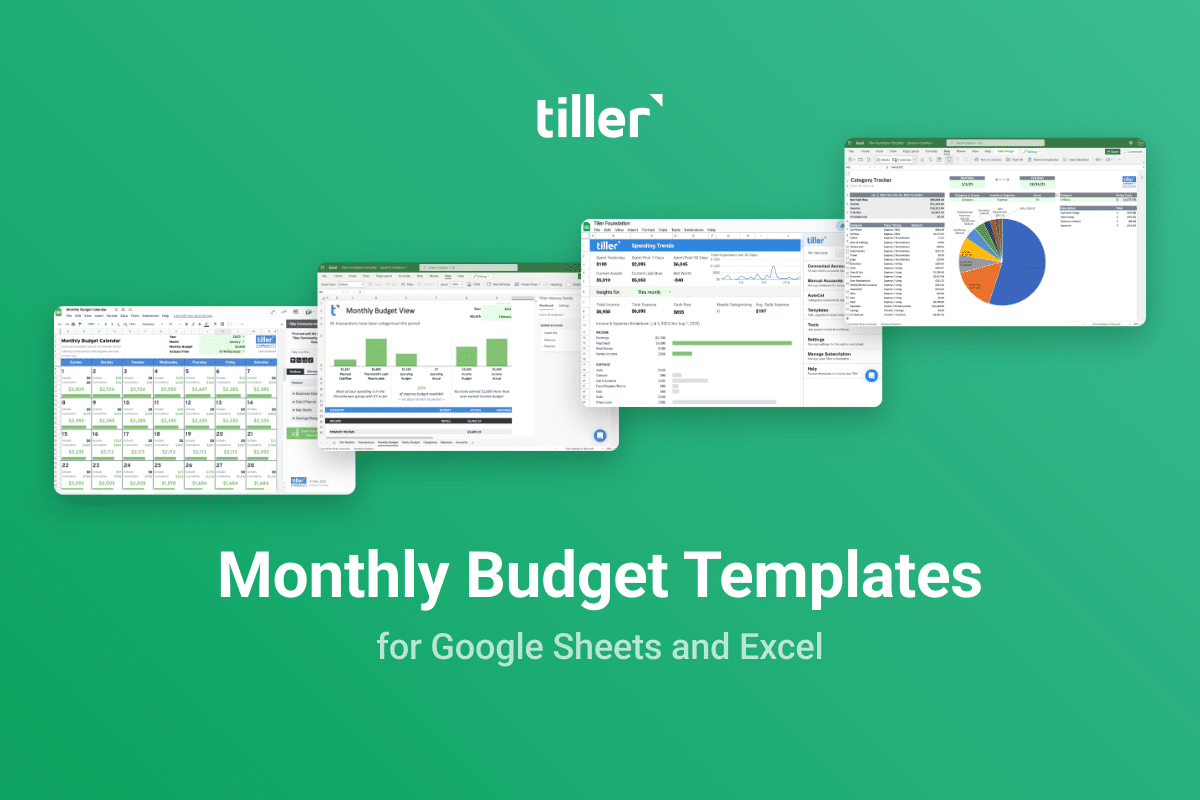

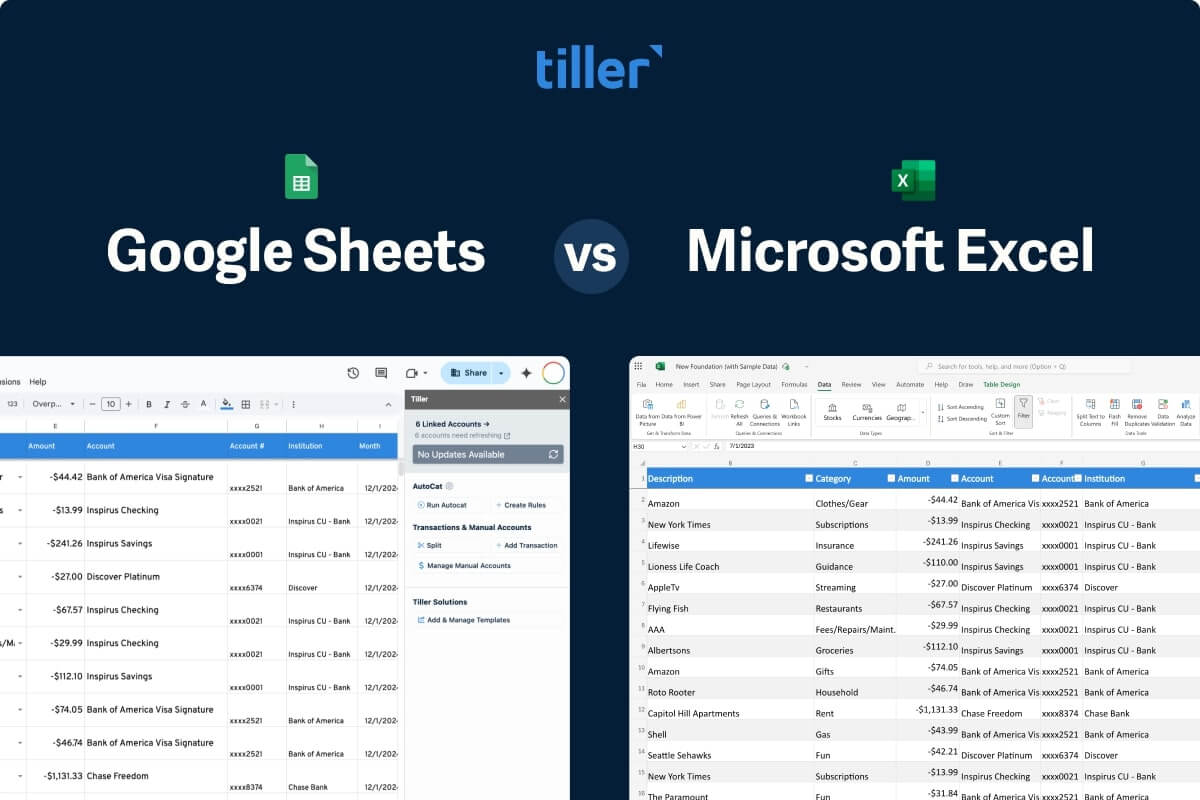

For the past few years, Tiller Money has created powerful tools that automate personal finances in Google spreadsheets. We know spreadsheets provide the greatest flexibility and control for managing your financial life.

We’ve distilled our experience into an ultra simple spreadsheet budget anyone can use for free to help make sense of their finances in this time of economic uncertainty.

With this budget, you can see where your money is going in about ten minutes

Right now, there are many reasons why you might rather wash the dishes or take the dog for a walk instead of diving into your finances.

I get that. But I promise the time you spend focusing on your money will be rewarded with less anxiety, a heightened sense of control, and more progress towards the goals your money is supporting.

Whether it’s getting out of debt, saving for something important, or anything else, you can do this.

Let’s get started

The first thing to do is open this free, ultralight version of Tiller Money’s Foundation Template for Google Sheets.

Click “Use Template” in the right corner to create your own private copy of this template, and give it a name that reflects your intent.

You’ll see three sheets in bottom tabs of this streamlined version of the Foundation Template. To get started, open the second sheet labeled “Categories.”

Transaction categories are the foundation of any budget.

You should define your own categories. Don’t get stuck here. You can change them later. The template includes a few category suggestions. You can use them, delete them and make new ones, or use them as a starting point and later revise, delete, and add others.

You can see that the categories are organized by groups. This will come in handy when we look at our budget report with two simple groups of categories for expenses:

- A discretionary group, with expenses that are easier to increase or decrease in a given month.

- A living expense group, with necessary expenses like heat and groceries.

Finally, we have a category type column. This simply shows if the category is considered income or expense.

I added a few categories to make the spreadsheet reflect my situation. If you’re like me and you want to keep things tidy, you can arrange the categories so they’re clustered in a logical fashion.

Now we’re going to set a spending budget for each category.

Go down your list of categories and estimate what you plan on spending in each category each month.

Make your best guess, but know that you will probably get it wrong in your first month. (Maybe even way off.) That’s okay.

Budgeting is an interactive and iterative process. You’ll get more accurate over time. You’ll come back and you’ll laugh at some of these budget numbers next month, but don’t let that stop you.

In my example, I’ve set a budget $50 for eating out and a hundred here for clothing and gear.

Enter transactions into your spreadsheet

To see where your money is going, and where it’s likely to go next, you’ll need to get the past few weeks of transactions in your spreadsheet.

To keep things simple, we’ll assume you’re manually entering transactions from your credit card and checking statements.

But there are a few other ways to get transactions into your spreadsheet:

- You can copy and paste them from PDFs of your account statements.

- You can log into your various accounts, download CSV files of your transactions, and import them into your spreadsheet (Read more)

- You can use the Tiller Money Labs Import CSV Line Items tool (You need the free Tiller Money Labs add-on for this)

- To quickly work with the most complete record of your transaction data, you can sign up for a free month of Tiller Money. It will import up to 90 days of perfectly formatted transaction data from all your accounts. You can cancel before you’re billed at the end of the month and still keep the data you imported.

Enter every transaction you’ve had so far this month.

Then update your spreadsheet each day as you continue to spend.

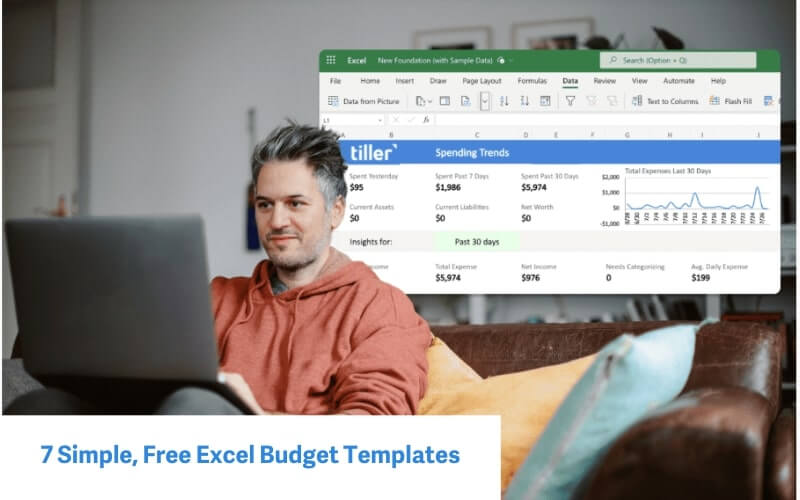

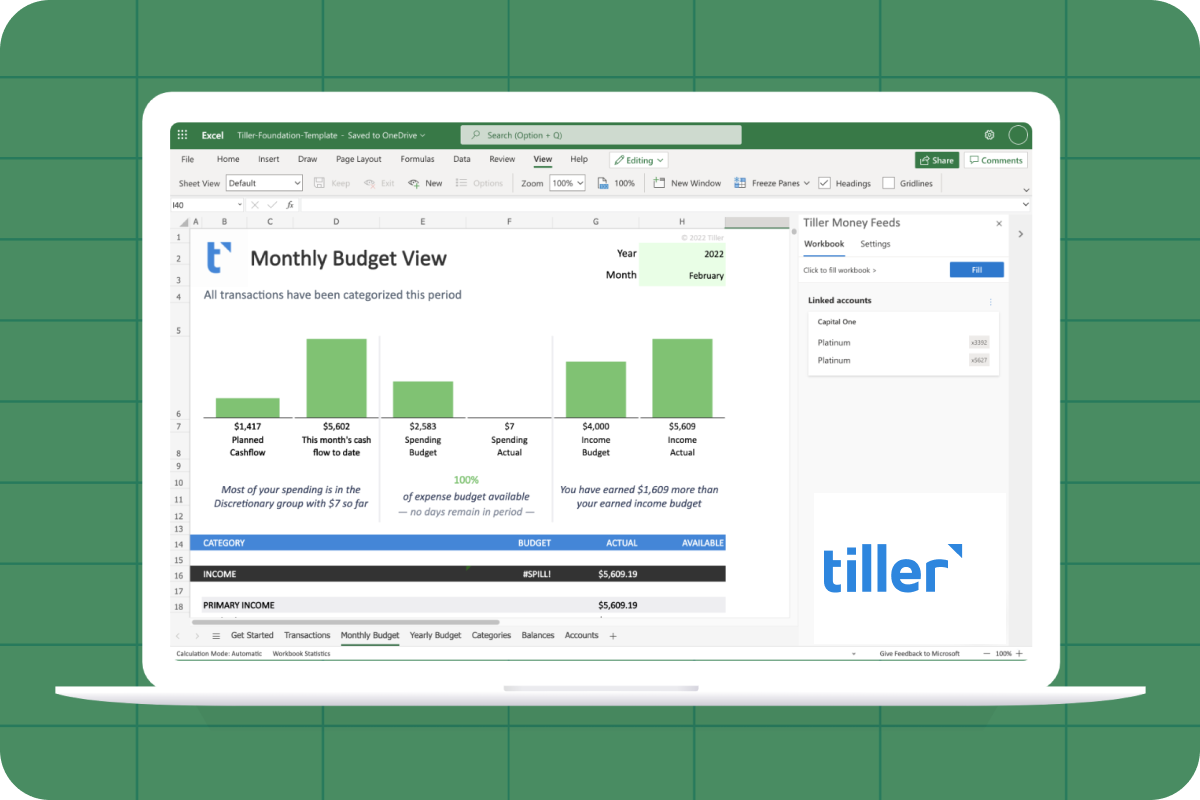

Next, let’s look at the Monthly Budget Sheet. When I chose the current month, this sheet and its reports come alive.

My plan to cashflow is going to be $515 positive. My current cashflow only partway through the month is $978. We can see my spending budget of $2,995 and actuals of $2,694. Similarly, I can see my income budgeted and actuals as the month goes.

These will continue to update as new transactions are added to the budget.

Your budget is likely going to be way off, maybe wildly off, and that’s okay.

In fact, your Google Sheet might look downright disastrous.

But you’ve just taken a huge step forward by getting all your numbers into one place. That’s a victory.

So keep at it, and you’re going to see all your numbers slowly start to improve.

Depending on where you are with income and expenses, you might get your budget right sized next month, in three months, or maybe next year.

If making things better requires seeking a different source of income, or changing your housing, right-sizing your budget is going to take time.

But whether change happens slowly or quickly, this budget is going to be your guide to help get you there.

Scrolling down the Monthly Budget report, you will see all of your expenses totaled by category. Each category is organized by group, and each group is organized by type. (This is where those extra columns from the category sheet are helping us.)

In my example, the first column of numbers shows my budget. The second column shows my actual income and expenses. The final column shows where I have budget remaining or where I spent beyond my budget.

I can see that we’re running over on gear and clothing. Similarly, we’re running hot with charitable giving and groceries. As you add more transactions, this report will continue to be updated.

You can roll this report forward by selecting the next month. You’ll want to revisit the category sheet and enter in next month’s budget too.

Now you have a simple yet powerful tool to help you better understand where your money is going.

If you want to take your budget to the next level with automated daily feeds of all your transactions and balances from all every bank account you own, sign up for Tiller Money Feeds. We’ll make sure that your transaction sheet always has her latest spending and income each day.

Seeing all your spending and transactions in one place is transformative. Try it. Dive into this spreadsheet I just shared with you today.

You can be one of the few that actually knows where your money is going.

Have questions or feedback about this template?

Share them in the Tiller Money Community