How to Track the Top Financial Goals for 2023 With Tiller

Tiller brings all your finances together in one place, with flexible templates for paying off debt, budgeting, and saving money for retirement and your emergency fund.

About 2 in 3 (or 66 percent) of Americans do not expect their personal finances to improve in 2023, according to a new Bankrate poll:

Survey: 66% of Americans don’t see their finances improving in 2023

- 36% expect their financial situation will remain about the same

- 29% expect their finances to get worsen

- 34% have hope that their personal finances will improve

Other surveys have similar findings: paying down debt, building an emergency fund, budgeting better, boosting retirement savings, and investing more money at the https://www.bankrate.com/personal-finance/personal-finances-outlook-survey/ Here’s advice on how to stick to your goals:

When we asked over 500 people about their biggest financial goals for 2023, the top five answers were:

Multiple surveys show similar results: most people want to pay down debt, spend less, and save more.

These are big and life-changing personal finance goals. Helping people achieve them is why we built Tiller.

Here’s how Tiller can help you achieve your goals in the year ahead.

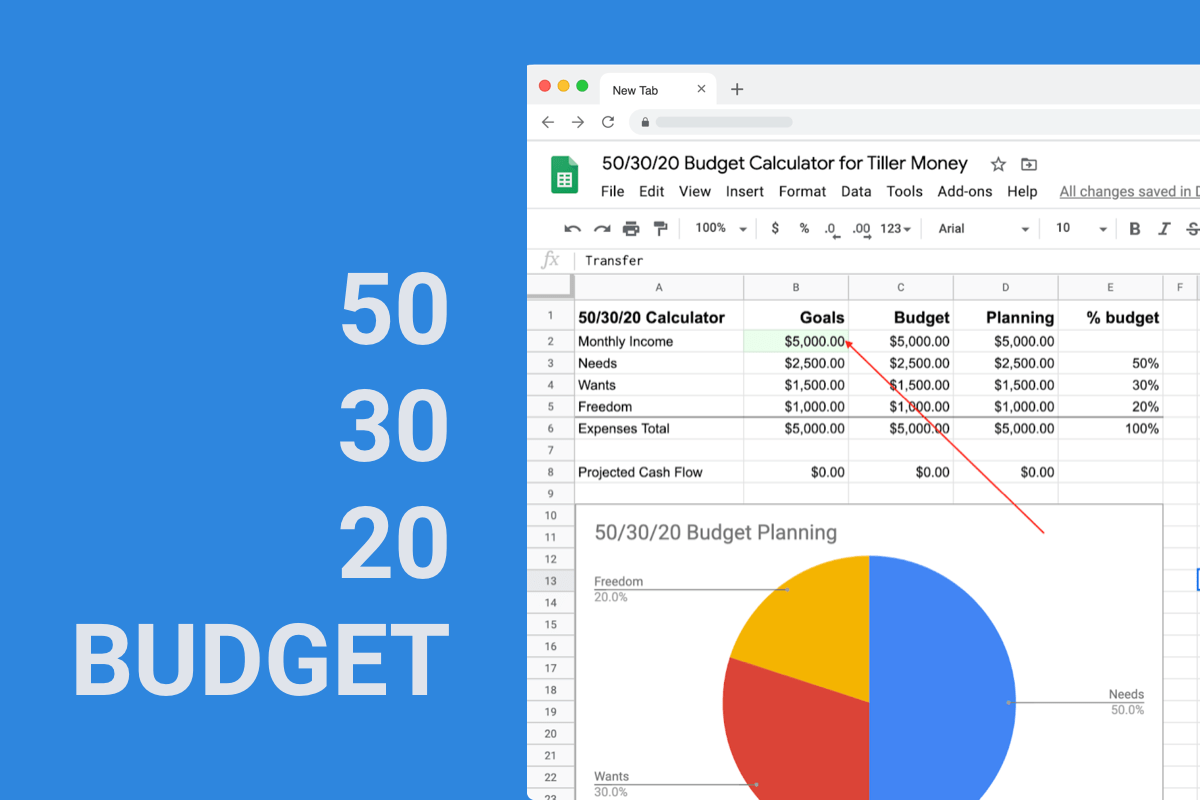

1. Budget and spend less

Budgeting forces us to face the reality of how we spend. It allows us the opportunity to see the gap between what we say is important to us and how we spend our money.

– Carl Richards

According to a Goldman Sachs Financial Resolutions Survey, “spend less money” is the #1 personal finance goal in the United States.

Modern life is becoming increasingly. The routine costs of shelter, food, transportation, and health care can burden even the most frugal and/or high-earning families.

But before you can consistently spend less than you earn, you first need to know exactly where your money goes each day, week, and month.

Financial experts agree that, even before budgeting, tracking spending is the first and most influential step to spending less.

Rule of thumb: if you’re having trouble keeping your spending down, focus on just two areas of problem spending.

It starts with tracking your expenses

Fortunately, Tiller is the easiest and most powerful tool for tracking expenses.

Not only does Tiller automatically gather all your spending in one place, it also provides 100% complete control of how you choose to categorize those transactions.

Tiller can even auto-categorize your transactions based on your custom rules.

Jumpstart your budget with a prebuilt spreadsheet template

When you’re ready to create a budget to help you optimize your spending, Tiller offers the flexible Foundation Template which includes both yearly and monthly budgets.

Even if you have no intention of following a budget, making one is incredibly valuable. Planning how you can use your money can free you from stress, confusion, and uncertainty.

Once you’ve created your budget, you can more easily see how much you can really afford to save each month.

Additionally, the vibrant Tiller Community is here with helpful budgeting advice and motivation to help you succeed.

2. Build an emergency fund

“My main goal for is to consistently save $1,000 a month so we can knock out our emergency fund goal and start saving for a home down payment.”

Amandaleslie122, Tiller Community

To protect yourself and your family from unforeseen financial hardship, Vanguard recommends having at least 3 to 6 months of living expenses in savings as an emergency fund.

You can easily set savings goals directly in the Foundation Template mentioned above. This will show you how much you can afford to save each month. You can then automate savings each time you paid into your emergency account.

Indeed, “paying yourself first” via automation is probably the most realistic way most people can increase their savings.

Tiller Community Solutions also offers several free templates for tracking and visualizing your savings goals in a spreadsheet.

3. Reduce debt with a payoff plan

Paying off debt is the biggest financial goal in the United States.

This goal is especially pressing now, as interest rates are set to go up next year.

The Debt Planner Spreadsheet makes it easy to track all your debts and liabilities in one simple dashboard. The spreadsheet also helps you evaluate different payoff strategies such as the snowball and avalanche methods.

And best of all, the Debt Progress Spreadsheet is automatically updated each day with your latest credit card spending, balances, and payments.

Many people prefer the “snowball” method for paying down debt. Research shows it’s the most effective overall approach for the largest number of people. It’s based on a simple formula: “pay off the smallest debt first.”

But again, with the Debt Planner spreadsheet, you can model and choose any payoff strategy that works for you.

4. Increase your retirement savings

Preparing your retirement takes careful planning that begins years in advance. A spreadsheet is a perfect tool for the job. It’s also one financial planning tool you will never outgrow.

The free Retirement Planner Spreadsheet from Tiller Community Solutions connects with your Tiller-powered spreadsheet and helps you estimate the value of your savings and investments into the future.

5. Generate more income

For many people, earning additional income is a major or even necessary financial goal. If you’re looking for ways to earn a second income, check out this free spreadsheet ranking 145 side hustles.

When you start earning side income, Tiller provides two templates to make managing cash flow and taxes easy:

- Tiller Simple Business Spreadsheet: Effortlessly track business expenses, know your cash flow, stay organized, and mix and manipulate data from multiple sources.

- Quarterly Estimated Tax Google Spreadsheet: Track expenses and easily estimate your small business quarterly tax payments, all in real-time, all in Google Sheets.

Over 8 million freelancers and small business owners say they prefer to manage their business finances in a spreadsheet. Tiller Money’s automated feeds make those spreadsheets faster, easier, and more reliable.

Bonus: Stay financially in sync with your spouse

A Tiller-powered spreadsheet is the easiest and most flexible way to manage joint accounts and successfully reach money goals with a partner.

Because Google Sheets and Excel online are based in the cloud, you can open your budget spreadsheet anywhere, and invite your partner to do the same as an equal contributor.

If you have a purchase you need to communicate about, Google Sheets allows you to tag the other person via email, alerting them to the need for further communication.

See: How To Use A Spreadsheet To Manage Shared Expenses

Try Tiller Completely Free

Tiller was designed to help you reach your financial goals.

As Fast Company notes, “Spreadsheets + money = a sense of control.” People who switch from a personal finance app to a spreadsheet are “92% are more aware of their spending habits.”

Tagged: budget, financial goals, goals, Tiller Tips, track spending