What Financial Professionals Need to Know About Tiller

Sign up for Tiller’s Directory of Financial Professionals

Tiller has launched a directory of financial professionals who use Tiller for our many customers who have requested such a service. Get listed by filling out the form linked to the button below!

Tiller is the only personal finance service built on Google Sheets and Microsoft Excel.

Each day Tiller automatically imports our customer’s latest spending, income, transfers, and account balances into their own private spreadsheets. Flexible pre-built templates help them track cash flow, budgets, debt, and net worth.

We chose to automate spreadsheets rather than build yet another app, because spreadsheets are the most flexible, trusted, and collaborative tool for managing money.

Secure collaboration with spreadsheets

As a financial professional, you’re probably very comfortable with spreadsheets. Perhaps that’s why so many advisors have already discovered ways to use Tiller with their clients.

But it’s also because Google Sheets and recent versions of Excel are built for secure sharing, effortless collaboration, and access anywhere you get online. Additionally, spreadsheets offer:

- Version control and built-in backups

- Financial tracking without sharing bank logins or account access

- Unlimited flexibility and collaboration

- Fine-grained permission control

- Powerful reports that can be exported and emailed as spreadsheets or PDFs

- Read more about collaboration with Tiller-powered spreadsheets

Flexibility and Customization

Because Tiller is so flexible, it can be used to track almost any financial goal. However, most financial professionals use Tiller with their clients to:

- See a holistic view of a client’s net worth in one place

- Create a dashboard tracking all inflows and outflows from every account

- Track cash flow in one place

- Create budgets and manage spending

- Create and track debt payoff progress

- Identify areas to spend less and save or invest more

- View categorized monthly income and spending in a spreadsheet you can export

- Generate easy reporting of tax-deductible expenses

- Generate customizable financial reports for client’s small business

- Devise debt payoff plan with customized methodology and track client progress

- Use AutoCat to auto-categorize large volumes of historical transactions

How Tiller supports financial professionals

Tiller was founded to help individuals manage their personal finances. We don’t currently offer dedicated billing or tools targeted to financial professionals.

However, we do offer resources for those who want to use Tiller with their clients. These include:

- Guide for Financial Professionals

- Coming soon: Tiller’s Directory of Financial Professionals

Financial Professionals Directory

Over the years, many of our customers have sought recommendations for financial planners, accountants, etc. who use Tiller. To support these customers, we’re creating a new directory of financial professionals who use Tiller in their practice (or even in their personal lives).

To be included in this directory, please complete this form. You’ll hear from us to confirm your details before the listing goes live.

Is Tiller right for my clients?

Tiller is most appropriate for use with clients who want to be involved with tracking their finances in their spreadsheets.

When using Tiller, managing bank feeds will likely require participation from your clients. Your client may occasionally need to re-authenticate their bank accounts due to security-related disconnections (i.e., re-enter credentials to provide multi-factor or two factor authentication codes). The frequency of re-authentication varies by institution.

Account Management with Tiller

Customers subscribe to Tiller and manage their user accounts exclusively with their private Google or Microsoft account credentials. Those accounts are required because that’s how Google and Microsoft secure customer spreadsheets.

Customers should generally not share their Google or Microsoft account login credentials with their advisors, as these credentials also provide access to other private services such as email.

At this point, the customer can optionally share their new Tiller-powered spreadsheet with their advisor. There are several easy, secure ways to do this, as described in our Guide for Financial Professionals. This guide is available in the private Tiller Community Category for Financial Professionals.

Choosing Google Sheets or Microsoft Excel

Most Tiller features are available for both platforms:

- Tiller Money Feeds

- Foundation Template

- AutoCat (automatic transaction categorization)

- Top-rated customer support

- Access to the Tiller Community

- Daily Email with recent account transactions and balances

- Foundation Template

Tiller also provides a library of free templates created by the Tiller Community. Most of these templates are only available for Google Sheets, but more are being added monthly.

Additionally, some features are currently only available for Google Sheets. These include:

- Tiller Community Solutions add-on with dozens of free templates

- Transaction splitter utility

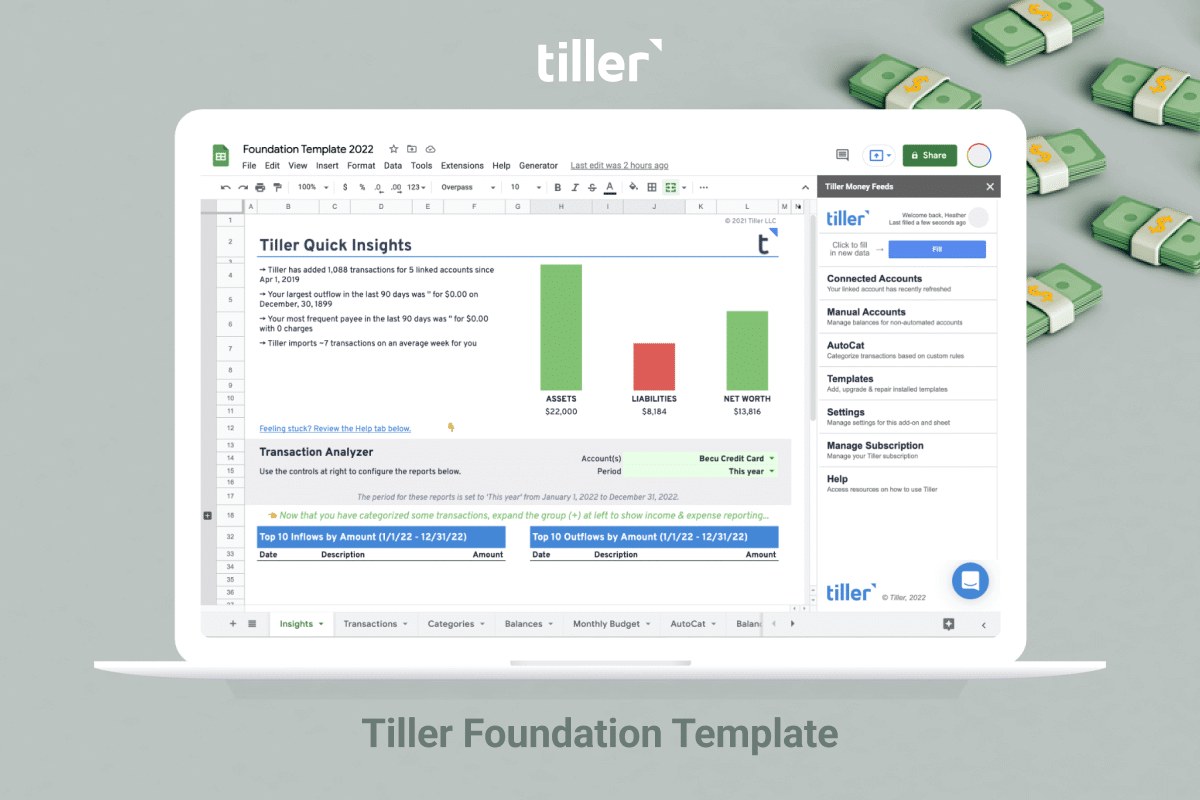

More about the Tiller Foundation Template

Tiller Money Feeds can be used with qualifying Excel workbooks and any Google Sheet, including your own custom template.

However, we recommend using Tiller’s Foundation Template. It’s the easiest way to get started with Tiller, and it’s fully supported by our customer success team. The Foundation Template includes the following core sheets:

- Spending Trends

- Transactions

- Categories

- Account Balances / Net Worth

- Monthly budget

- Yearly budget

Billing and Discounts

Tiller is completely free to try for 30 days. After 30 days, an annual Tiller subscription is $79.

Customers manage payment for their Tiller subscription in the Tiller Console. They login to the Console with their Google or Microsoft account credentials.

Tiller does not currently process subscription payments from financial professionals on their clients’ behalf. However, Tiller gift cards are available to purchase and give to your client.

Enterprise and bulk discounts are not available at this time.

Getting Help and Support

Tiller’s customer support is top-rated as you can see in our many Google Workspace reviews.

“Best financial management and budgeting tool. Specifically awesome customer support and an amazing community they built around the tools. Overall, I’m very happy with Tiller.”

– Kiran Bulusu, Google Workspace, June 9 2023

Your clients can directly reach out to Tiller. If you prefer to reach out to us on your client’s behalf please use this workflow:

- Send an email to support@tillerhq.com

- Use a descriptive subject line including the institution name and general issue

- CC your client’s Tiller-subscribed email account

- Provide the details of the issue including which accounts are affected, transaction dates, error messages, etc.

Tiller is trusted and recommended

Tiller currently has a 4.8-star Google Workspace rating from over 68,000 installations and a 4.5-star rating from Microsoft AppSource.

In 2022, Microsoft exclusively selected Tiller as their recommended personal finance service for users of Money in Excel.

“Tiller has helped my clients stay organized, and helped me build better and more suitable financial plans by finally understanding where their cash flow is going. In fact, I was so impressed with it, that I’m now also an avid user of Tiller Money for my own household!”

– Lindsay Bourkoff, CFP®, Kitces.com

“My favorite part of Tiller Money is the ease with which you can review and plan out spending with a client.” – Vineet Prasad, AFC®, – www.afcpe.org

How Tiller protects customer privacy and security

Security and privacy are top priorities at Tiller. Our business model is based on customer subscriptions, not selling customer data to third parties.

A truly unique feature of Tiller is that the customer’s financial data is stored in their own private spreadsheets. They never need to worry about exporting their historic data from Tiller – they always own and control it, even if they cancel their Tiller subscription.

We do not see nor store bank credentials. Our data feeds are provided by Yodlee, the trusted industry leader for financial data aggregation that provides the same service to 9 of the 15 largest U.S. banks.

Your client’s credentials are encrypted in the browser and passed directly to Yodlee.

Yodlee provides a read-only token granting Tiller’s servers visibility into your client’s transactions. We use bank-grade 256-bit AES encryption to feed bank data to Google Sheets and Excel workbooks.

We also can’t see personal transactions or balance data.

You can read more about Tiller’s security at Tiller Security And Privacy Promise.

Try Tiller Free

The best way to see what’s possible with Tiller is by starting a completely free 30-day trial. Your card isn’t charged until the end of your trial, and you can easily cancel anytime.

Sign up for Tiller’s Directory of Financial Professionals

We are now building a directory of financial professionals who use Tiller for our many customers who have requested such a service. To be included in this directly, fill out the quick form with the button below!

You must be logged in to post a comment.