Envelope Budgeting in Google Sheets

If you’re just starting out with budgeting, it’s likely you’ve heard of the envelope system.

Here’s how to use envelope budgeting in Google Sheets.

A Refresher on Envelope Budgeting

Traditionally, the envelope method involves making categories for all your expenses, writing those categories on a bunch of envelopes, then putting a set amount of cash inside each envelope each paycheck.

You only spend from those envelopes. When you take money out for expenses, you can see exactly how much is left. This can make you think twice about spending excessively in any given category. Because when that cash is gone, it’s gone.

Getting Started With Envelope Budgeting System

To make an envelope budget, you’ll first need to make a list of all of your expenses by category. For example, your budget might include categories like those included by default in Tiller Budget:

- Phone

- Utilities

- Eating Out

- Gear & Clothing

- Home Improvements

- Subscriptions

- Travel

- Classes

- Stuff

- Auto & Gas

- Charity

- Groceries

- Misc

- House

- Repairs

- Freelance

- Paycheck

- Transfer

- Parking

- Reimbursable

Everyone’s categories will look slightly different, which is why it’s so important to go through your own expenses before you get started with the envelopes.

Once you have the categories sorted, break down how much you’ll need for each category each paycheck. Depending on how often you are paid, this may be once a month or every other week.

Now you’re ready to get out those envelopes. You’ll need as many envelopes as you have categories. Write the name of one category on the front of each envelope.

Do you need to use cash to get the benefits of Envelope Budgeting?

There are several ways to use envelope budgeting without taking all the money out of your bank account.

- Apps like Mvelopes allow you to use digital envelopes.

- Many banks and credit unions will allow you to segment your checking or savings accounts by category to achieve the same effect.

- For example, Simple has a sophisticated envelope system they call “Goals” – “Goals are digital envelopes.” It’s pretty nifty: check it out here.

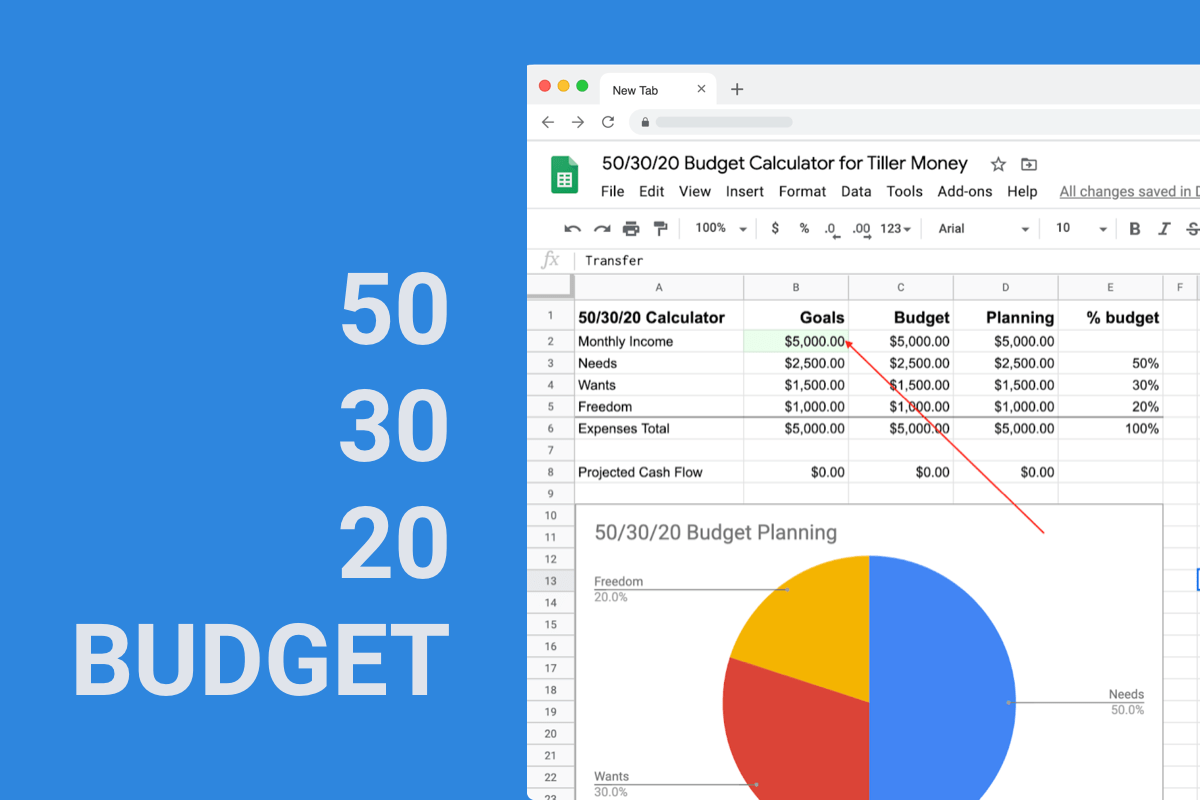

Our new Tiller Budget brings powerful, automated envelope budgeting to Google Sheets. Instead of writing spending categories on paper envelopes, you make them in a Tiller-powered Google Spreadsheet. (You can create up to 200 categories. )

Envelope budgeting with Tiller Budget is based around a feature called “rollovers.” Category rollovers are like mini, virtual savings accounts.

Tiller starts you off with a base set of example categories (see above), but you can overwrite or delete these entirely.

Your categories should reflect the way you want to organize your budget. Where do you spend your money and how do you earn it?

As you spend and receive income, you will accrue savings (or debt) on a category-by-category level. The net budget-versus-actuals on each of these categories will accrue as a rollover at the end of each period. You may start a period with a favorable rollover if you underspent on Groceries, for example, or an unfavorable rollover if you had an unexpected Auto repair.

The intent is that you allocate every dollar you plan to earn to an expense category, including savings.

Is the envelope system effective if you’re not using cash?

Studies show that parting with cash is more painful than swiping your card, and that you feel a more positive emotional connection to your purchases when you use paper over plastic. If you’re just starting to budget, it’s likely because you realize that something about your spending or saving habits needs to change for the better.

While every individual is different, studies show that generally, you’re going to have an easier time achieving those goals if you use cash rather than digital money.

After establishing better money habits, you may decide to go from cash to digital for convenience’s sake. Tiller Budget makes this easy.

Just be sure that when you make the switch, you don’t lose those positive habits you’ve worked so hard to establish.

Is it okay to borrow from another envelope?

There is no god of envelope budgeting, dictating the rules you must follow. However, there are certain things you will want to consider when establishing best practices for yourself.

Let’s say you budget $75 for clothes this month, but you find a really cute pair of jeans for $100. Is it okay to borrow $25 from another envelope to cover the costs?

Ultimately, you get to make the moral judgment. If you’re borrowing money out of your entertainment budget and you fully recognize that you’re sacrificing $25 of fun in favor of stunning denim, that might be all right. But if you’re borrowing $25 from the money you’re saving to build up an emergency fund, you’re working against your own best interests and defeating the purpose of setting up an envelope budgeting system in the first place.

Any budget can be customized to the individual—just make sure you’re not customizing your budget to accommodate your bad money habits.