The Top 5 Recommended Budgeting Methods

Here are the top five suggested budgeting methods to help you align your money management style with your financial goals.

The five recommended methods are:

Read: 4 Tips for Choosing the Best Budget Categories

1: Zero-based Budget

With a zero-based budget, every dollar is assigned to a budget category, such as transportation or retirement savings.

If you don’t use all the dollars assigned to a specific category, then the funds can be rolled over to a different category.

This method forces you to spend time each month creating a detailed plan for your spending and savings in the coming month, which naturally prepares your budget for increases in spending that occur around events such as holidays, wedding season, and back to school.

Who benefits from a zero-based budget?

This method is ideal for anyone who prefers a hands-on approach to budgeting. It’s also a great tool for folks just learning to budget as it provides the most detailed financial data of any of the other methods on this list.

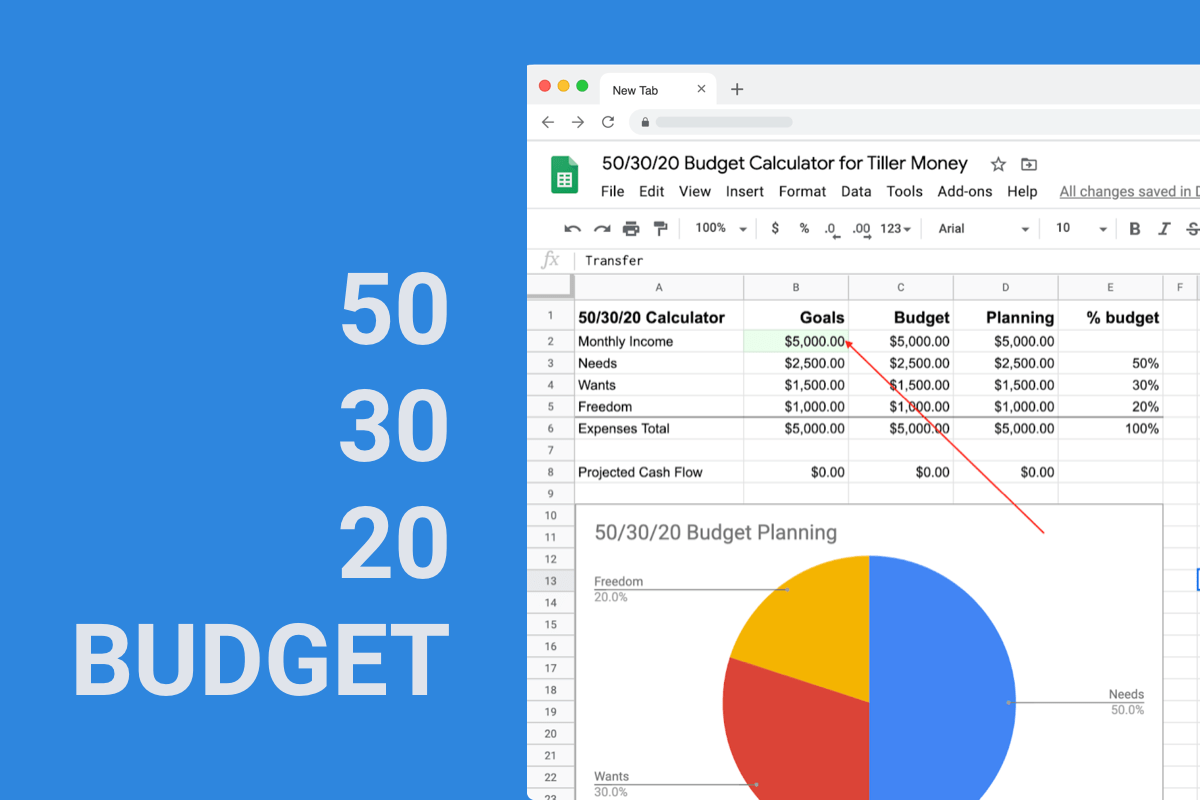

2: 50/30/20 Budget

The 50/30/20 budget is based on personal finance “rules of thumb.”

The idea is that if you allocate 50% of your post-tax income to needs (housing, bills, food), 30% to wants (eating out, travel, personal care items), and 20% to freedom (debt payoff and savings), you will automatically limit major expenses while still saving enough to be financially secure.

If you use this method, you may find that a slightly different ratio works best for your financial situation. However, keep in mind that the combined percentage for essentials and personal expenses should not exceed 80%.

Who benefits from a 50/30/20 budget?

This method is ideal for those concerned with big-picture financial information because it considerably limits the number of budget categories you have to contend with.

Regardless of the budgeting method you use, it can be helpful to figure out how your spending and saving percentages measure up to the 50/30/20 budget rule.

3: Envelope Budget

The envelope budget is a tried-and-true cash-based budgeting system that has helped many people smash debt and curb bad spending habits.

With this system, your budget categories are represented by envelopes. Each envelope is filled with the exact amount of money you can spend on that category, and when the money runs out, you can’t spend any more.

While confining yourself to using only cash and carrying around physical envelopes may seem old-school, studies show that doing so may actually reduce your spending.

Read more: Envelope budgeting in Google Sheets

Who benefits from the envelope budget?

This method is ideal for anyone hitting the reset button on their finances because it sets hard limits on spending while also eliminating the risk of checking account overdrafts or carrying a credit card balance.

This method also works well in combination with other budgeting methods. For example, if you’re trying to reduce how much you spend on restaurant meals, use the envelope method for your restaurant budget category.

4: Values-based Budget

The values-based budget prioritizes you over the numbers in your budget.

It recognizes that regardless of your income, you are still a person who works hard and deserves to have some fun with your money.

With this method, you make a list of your values from most important – such as food and shelter – to least important.

Next, you calculate the monthly cost of each value and then figure out how far down the list your can stretch your income. If you can’t afford all your values, then you either need to re-prioritize or reduce the expenses associated with each value.

Who benefits from the values-based budget?

This method is ideal for people who have trouble sticking to a budget because it shifts focus away from the numbers and adds emotion to the budgeting process.

5: “Pay Yourself First” Budget

The “pay yourself first” budget is the simplest of all the budgeting methods on the list.

With this method, you decide how much to allocate to your savings goals and all of your remaining money is free to be spent however you choose.

By far, this method allows for the least amount of planning and oversight.

Who benefits from the “pay yourself first” budget?

This method is ideal for budgeting pros or people with incomes that are high enough as to make a budget optional.

With so many different approaches to budgeting that can be tailored to your specific financial life, it’s easy to create a meaningful tool for tracking your progress toward your financial goals and preventing bad financial habits from derailing your efforts.