How I Budget With Tiller

Tiller’s most basic function is to import daily transactions and account balances from your various financial accounts so you can see them in one place.

This provides the ability to see where you sit financially at that moment.

Automated account aggregation is powerful, but typically when we want to know our financial situation, it’s because we’re thinking about the future.

- Can we get a new car?

- Will we be able to afford to move to a different house?

- Can we retire with our current level of spending?

Thankfully Tiller includes tools to take you beyond “what do I have” into “what will I have” and “what will I need”.

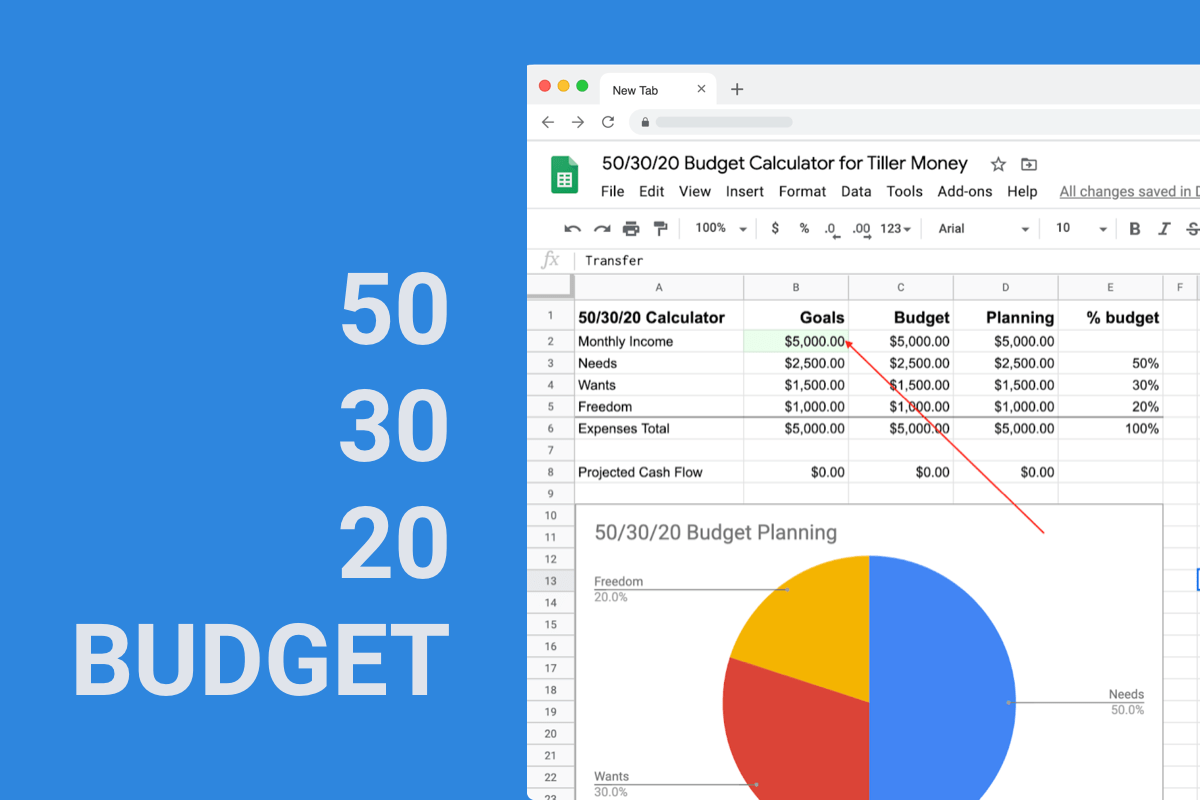

Tiller offers a wide variety of templates, but most that look into your future finances fall into two categories: Planning and Budgeting.

Spreadsheet planning templates are used for saving towards the more expensive items we need every now and then. I haven’t been doing much long-term planning since I don’t have extra money to stash away for those future items.

Luckily we don’t have any debt, but if we did, I’d probably be using the Debt Planner template. Tiller offers a number of other useful planning templates that I’ll look to when the need arises, including:

Spreadsheet budgeting is where I’ve spent most of my time in Tiller. Tiller offers a few prebuilt budget templates, like the Foundation Template with its Monthly Budget and Yearly Budget.

Tiller Community Solutions offers the Savings Budget, along with others for determining what your budget will be.

Here’s a list of the Tiller templates I’ve used to build my budget, and some examples of how they’ve helped me progress toward my goals.

Starting With the Categories Sheet

Like most, I started with the built-in budget tool, which is in the Foundation Template’s Categories sheet.

By entering how much you think you’ll spend each month for each category, you can then use the Monthly Budget and Yearly Budget sheets to understand how much money you’ll need, and when you’ll need it.

While first using this method, I realized our expenses were exceeding our income, which started my quest to get my finances in order.

Using the Budget Builder Template

When I wanted to get a little deeper into budgeting I used the Budget Builder template, which works really well when you want to base this year’s budget on last year’s budget.

It offers some great tools to see what you spent and decide how your spending this year will compare.

It also offers ways of either taking out “one-time-only” expenses from last year or adding in new “one-time-only” expenses for this year to get a more accurate budget.

Looking back at last year’s numbers this way helped to narrow down where we’ve been spending the most and which categories will make the biggest difference in our budget.

One of the changes I made was to find a cheaper phone plan, dropping from $86 per month to $25.

Using the Category Schedule Template

When the Category Schedule template was released, I gave that a try and liked the tools it offered to get more specific into each category.

For me, having a detailed list of budget items makes it easier to understand where my budgeted dollars are going. This is when I was starting to focus on those trouble areas in our budget, and break them out into smaller pieces that were easier to understand and then take action on.

We have a lot of pets, so I started breaking out all the expenses I could, like food, vet, grooming, etc to better understand where there was room to save.

We switched one of our two cats and two of our three dogs to Costco pet food, and they are just as happy as they were, and I’m even happier with the 50% cut in costs.

Creating my own custom Budget Plan template

I liked what the Category Schedule allowed me to do, but the interface didn’t fit how I thought about my budget items, so I created my own template called “Budget Plan”.

It allows for a highly detailed budget item list, with tools that make it easy to find your monthly costs by entering what you’re paying and how often you pay it.

My budget plan now includes 125 items which are ranked by how easy or difficult it would be to change their cost. I’m still adding and analyzing budget items, but for me, being able to see not only a category breakdown but even get down to the item level is game-changing.

I’m planning lots of changes and hope to trim the hundreds of dollars we need to get to a balanced budget. It’s not fun, but without Tiller and the ability to customize it, I wouldn’t be in a position to make these positive changes.

Depending on your needs, your journey may look very different, and you may find one of the tools I passed on to be just what you need.

That’s part of the beauty of Tiller; you can try lots of options for no additional cost and if you don’t find exactly what you’re looking for, you can try to build it yourself.